Your Free MSB Compliance Check-Up: Catch Problems Before Regulators Do

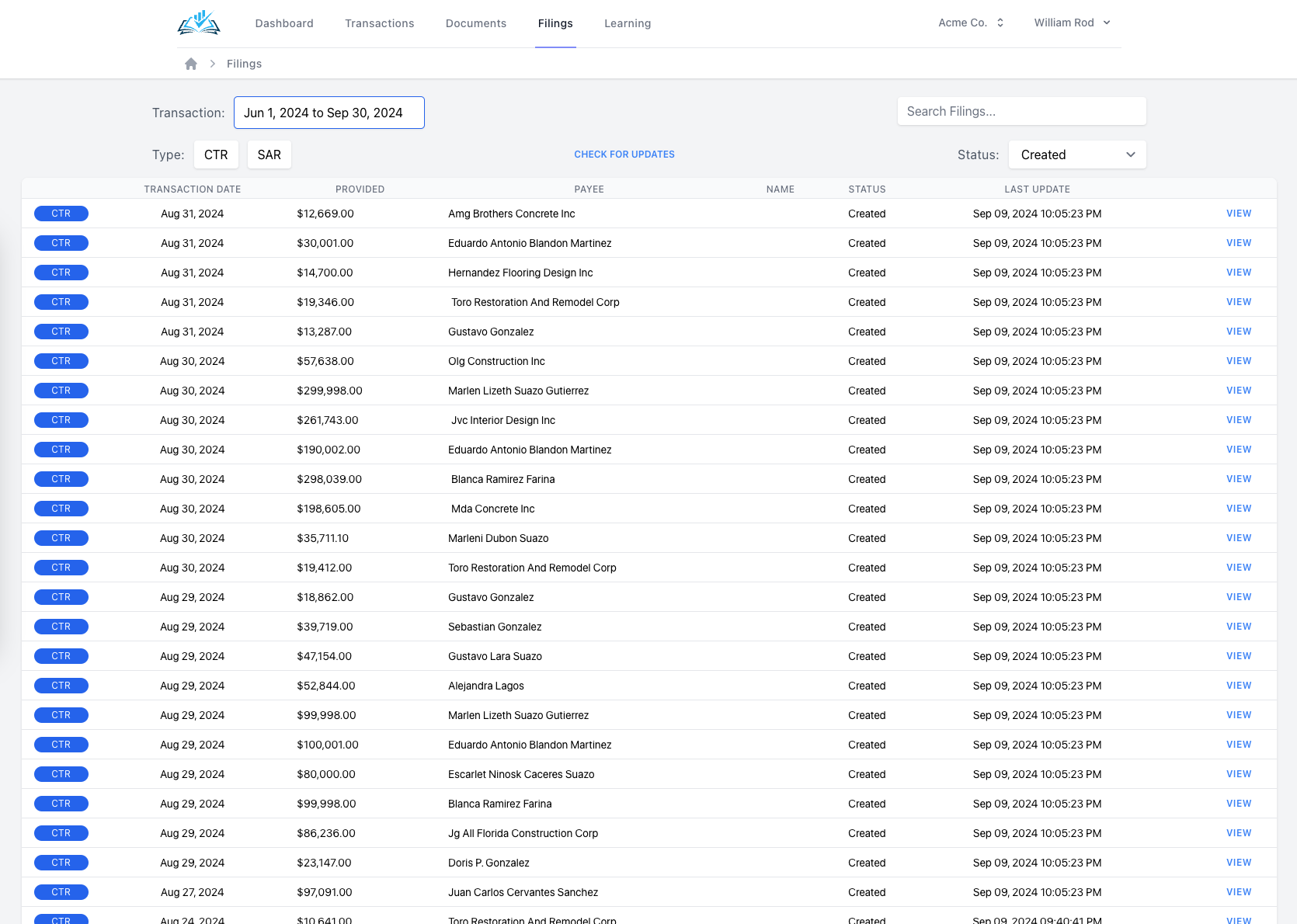

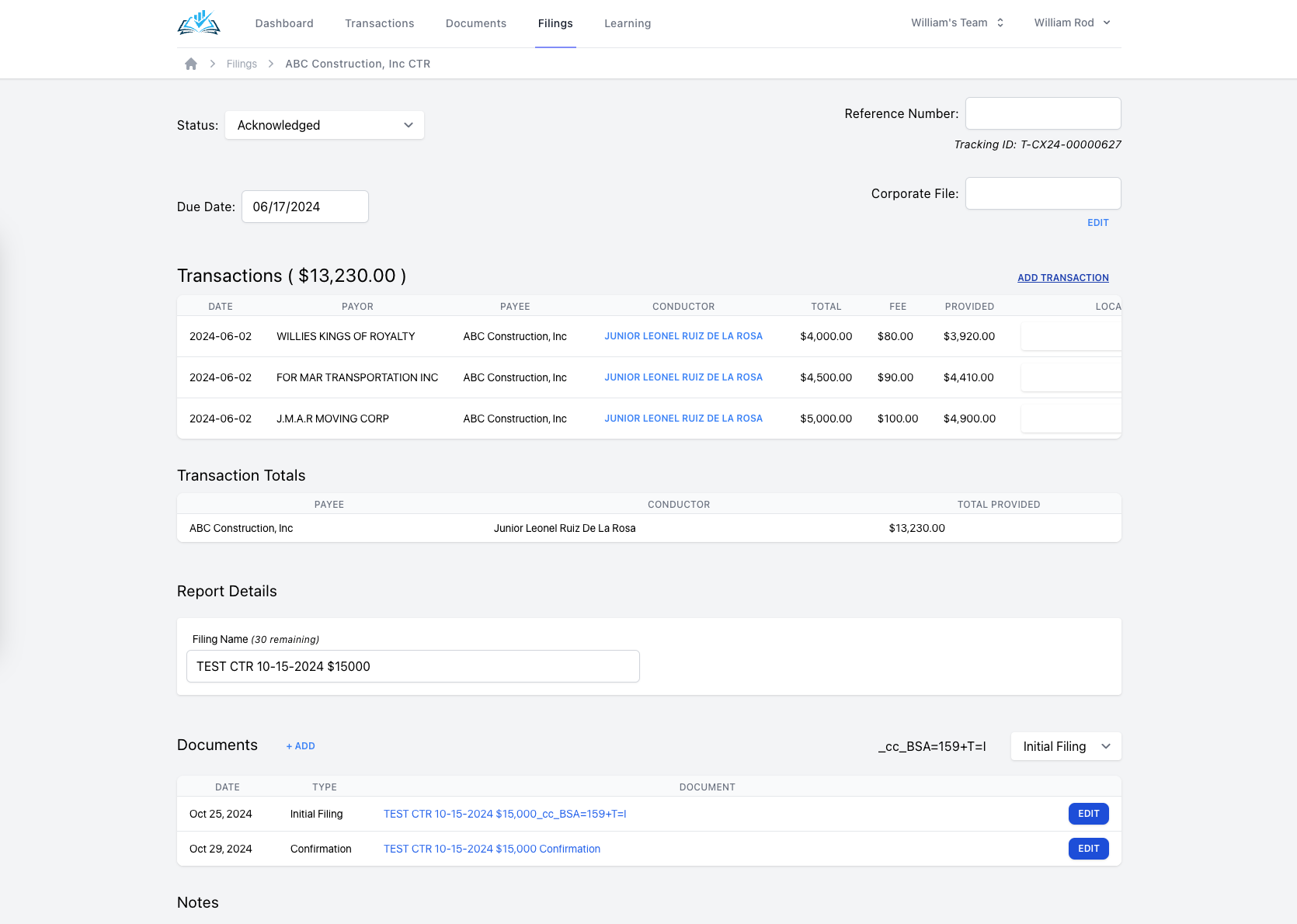

Running an MSB is tough enough without guessing if your compliance program would pass an exam. ComplyCheck’s Free MSB Compliance Check-Up reviews your AML/BSA Manual, FinCEN registration, CTRs, corporate files, training, and more — all at no cost. You either find weaknesses or gain confidence that you’re doing things right. What do you have to lose? Schedule your free check-up today.

Read Article